If you are a real estate investor, then you know the importance of screening potential investment properties. One tool that you can use to do this is the gross rent multiplier (GRM). The GRM ratio is simply the price of a property divided by its annual gross rental income. This number can tell you a lot about a property and whether or not it would be a wise investment.

For example, let’s say you are considering two properties. Property A has a GRM of 12 and property B has a GRM of 20. This means that property A would cost $12,000 for every $1000 in gross rental income and property B would cost $20,000 for every $1000 in gross rental income.

In this blog post, we will discuss the gross rent multiplier and how to use it to screen investment properties!

What Is The Gross Rent Multiplier (GRM)?

So, what is the gross rent multiplier? Gross rent multiplier is a tool that real estate investors use to screen prospective investment properties.

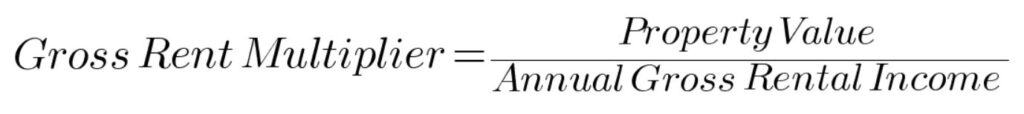

The Gross Rent Multiplier (GRM) is simply a ratio expressed as the price of a property divided by its annual gross rental income. In general, lower ratios mean higher cash returns for investors.

The gross rent multiplier can be used to compare similar properties. For example, if one property has a GRM of 10 and another has a GRM of 7, the rental property with the GRM of 7 will likely have a higher cash return because it is selling for a lower price in relation to its gross rental income. Put another way, the rental property with the gross rent multiplier of 7 has a higher rent compared to its price.

Gross rent multipliers aren’t useful in predicting the actual cash flow of a real estate investment. The formula does, however, indicate the likelihood that a property will be a profitable investment.

Gross Rent Multiplier Formula

The gross rent multiplier formula is very simple. All you need to do is take the price of a property and divide it by the annual gross rental income.

Gross Rent Multiplier = Property Price / Annual Gross Rental Income

It’s really that simple.

You can also use the gross rent multiplier formula in different ways. For example, you can set a target GRM and calculate the necessary rental income for a given purchase price. Or you can determine the fair market value of a rental property given a gross annual rent.

These alternate uses of the gross rent multiplier calculation can help you determine whether an individual property is a good investment. The caveat is that you need to know how to set a reasonable target GRM.

Gross Rent Multiplier Examples

Let’s say you are considering an investment property that costs $100,000 and has an annual gross rental income of $20,000. To calculate the gross rent multiplier, you would simply divide the property price by the gross annual rental income.

Gross Rent Multiplier = $100,000 / $20,000 = 5

Now let’s say you want to purchase an investment property for $250,000. To calculate the necessary gross annual rental income, you would set a target gross rent multiplier and divide it by the purchase price.

Gross Annual Rental Income = $250,000 / 5 = $50,000

In this example, we are using a gross rent multiplier of 5 to calculate the gross annual rental income to make the two properties comparable.

How And When To Use Gross Rent Multiplier

Now that you know how to calculate the gross rent multiplier, let’s discuss how and when to use it.

The Gross Rent Multiplier is a quick and easy way to screen investment properties. However, it is important to remember that the gross rent multiplier should not be used as the sole criterion for making an investment decision.

The reason for this is simple; the gross rent multiplier only looks at gross income and does not consider operating expenses, mortgage payments, interest rates, or any other factors that influence net operating income and cash flow.

For this reason, the gross rent multiplier should be used as a first step in the process of screening real estate investments. And it is best used to compare similar properties.

Factors To Consider When Calculating Gross Rent Multiplier

You should consider a few factors when calculating the gross rent multiplier. Some of these affect the calculation, like the property value and gross annual income. Others have no effect on the gross rent multiplier calculation, but will greatly affect your potential returns.

How can a real estate investor overcome these additional expenses and other factors? Lowering your target gross rent multiplier will provide a higher potential rental income to absorb additional expenses and risks.

Property Value

The property value is the most important factor in the gross rent multiplier equation. This is because the gross rent multiplier is a direct function of price. The higher the rental property value, the higher the gross rent multiplier will be.

It’s also important to remember that property values can fluctuate over time. So, if you’re using the gross rent multiplier to screen investments, be sure to use the asking price or fair market value for single-family homes. The property value of commercial real estate is determined as a function of capitalization rate and net operating income.

Gross Rental Income

The other term in the gross rent multiplier equation is the rental income. Higher rental income will reduce the GRM which likely signals a better investment among comparable properties.

Gross income is often influenced by property value. A more expensive property often generates a higher monthly rent. However, GRM normalizes the relationship between the property price and the gross income.

Net Operating Income (NOI)

One of the biggest drawbacks of the gross rent multiplier is that it doesn’t consider any expenses related to operating rental properties. Net operating income includes not only the income from the rental property; it also deducts operating expenses from the gross rents.

Property taxes, maintenance, insurance, utilities, and property management are normal operating expenses that you can expect to pay. These expenses directly reduce the profits from your rental property.

Age And Condition Of The Property

The age and condition of a rental property directly affect the cost of maintaining that property. For instance, a poorly maintained property may have considerable expenses to address ongoing problems. In contrast, a newer, well-maintained property will have lower maintenance costs.

Location

The location of your real estate assets can make a big difference in what gross rent multipliers are possible. Depending on the local real estate market, you may need to target higher or lower GRMs.

In general, highly populated metropolitan areas have higher average gross rent multipliers. This is primarily due to higher property value in these areas.

Sparkrental has some interesting analyses of average GRMs by metropolitan area. Here’s an interactive map of their data.

Financing

Finally, financing impacts the returns on income-producing property. It doesn't affect the gross rent multiplier calculation, but it does impact your bottom line.

Since financing comes with an additional expense in the form of monthly mortgage payments, you need to subtract these payments from the property's net operating income to determine your free cash flow.

What Is A Good Gross Rent Multiplier?

A good gross rent multiplier is less than 10 in many cases. However, the local market plays a big role in what gross rent multiplier can be achieved.

Once you have analyzed multiple properties in a given rental market, you'll get a sense of the average GRM for the area. And you'll see some properties have a lower gross rent multiplier than the average.

One thing to note is that average gross rent multipliers are fluid. As the fair market value of homes and market rents change, so does the gross rent multiplier.

This is why rental property investors should use GRM as a tool to quickly compare properties rather than as an absolute rule. When the gross rent multiplier is used to compare properties, it accounts for fluctuations in the local real estate market.

Benefits And Limitations Of The Gross Rent Multiplier

The gross rent multiplier has its benefits and limitations as a screening tool for rental properties. Real estate investors should be aware of these benefits and limitations to ensure the formula is used appropriately and the investor is aware of any risks.

Benefits

- Quick and easy to calculate. The gross rent multiplier only needs 2 pieces of information; the property's purchase price and the annual gross rents.

- Can be used to quickly compare multiple properties. Because the GRM formula yields a single number, it's easy to compare similar properties. The gross rent multiplier is often the first step in screening real estate investments.

- Takes into account market fluctuations. The average GRM you see today in your local market won't be the same as you see a few years from now. If you're using the formula to compare similar properties, you'll be focused on their relative GRM values which will change over time.

Limitations

- Doesn't consider operating expenses or financing costs. Insurance, a monthly mortgage payment, and property management all eat away a significant portion of the income a property generates. In the worst case, these rental property costs may be more than the income it generates.

- Doesn't provide cash flow information. Because the gross rent multiplier doesn't account for any expenses, it provides no insight into the monthly cash flow. How much can you take from the property each month? You'll need to perform a cash flow analysis.

- Doesn't consider any future upside. If your real estate investing strategy is to find value-add properties, the gross rent multiplier won't be of much use.

Gross Rent Multiplier Compared To Other Real Estate Metrics

Let's take a look at how the gross rent multiplier compares to other metrics in real estate investing.

GRM vs The 1% Rule

The gross rent multiplier and the 1% rule examine the same factors (property price or fair market value and potential rental income). The formulas are just inversely related -- GRM is the price divided by the rental income while the 1% rule looks at rental income divided by the price.

The other difference is that the gross rent multiplier uses the annual income while the 1% rule uses monthly income. This means that a property with a gross rent multiplier of 8.33 or less is the same as a property that satisfies the 1% rule.

GRM vs Cap Rate

Both the gross rent multiplier and capitalization rate can be used to determine rental property value. The difference between the two methods is the calculation using the property's cap rate considers net operating income while the gross rent multiplier considers only gross rental income.

Real estate investors can use both formulas to determine a property's market value and compare this with the property's asking price to see if it is a good deal.

Summary

Using the gross rent multiplier is a quick and easy way to screen properties. Whether you invest in single-family homes or commercial real estate, GRM can be helpful in quickly finding rental property opportunities.

The GRM is simply the ratio of the property's price divided by its annual gross rental income.

And it's best used as a first step in screening potential investments.

Do you have any other tips for real estate investors?