When it comes to real estate investing, cash on cash return is king. This metric tells you how much cash you can expect from a property as a proportion of the amount you’ve invested. In other words, it shows how quickly you will get your original investment back, and then some.

Cash on cash return is one of the most important metrics for investors to consider, and in this blog post, we will show you why and how to calculate it yourself.

What Is Cash On Cash Return In Real Estate Investing?

As we mentioned, cash on cash return is a metric that tells you how much cash you can expect to receive from a property as a proportion of the amount you’ve invested.

Cash on cash return in real estate investing is the rate of return expressed as the total pre-tax annual cash flow divided by the total cash invested (typically at the end of the calculation period). Cash on cash return is also called cash yield.

For example, let’s say you’re considering investing in a rental property that costs $100,000.

You expect to generate $12,000 in cash flow each year after expenses (mortgage payments, taxes, insurance, etc.).

Your cash on cash return would be 12% ($12,000/$100,000).

It’s important to note that cash on cash return does not take into account the appreciation of the property.

It is strictly a measure of how much cash you can expect to receive from the operation of the rental property.

Why Is Cash On Cash Return So Important For Real Estate Investors?

As we mentioned, cash on cash return is a measure of how quickly you will get your original investment back.

It also shows you how much actual cash you will have left over. This is important for real estate investors who are trying to make their primary income through real estate investments.

Put simply, cash on cash return will pay your bills, buy your groceries, and give you spending money. This is the most reliable way for real estate investors to get paid every month.

How To Calculate Cash On Cash Returns For Rental Properties

In most cases, real estate investors want to find the annual cash on cash returns. It’s useful to calculate cash on cash return over a timeframe (typically a year) to allow comparisons with other investments.

Let’s take a look at the steps to calculate cash on cash return.

1. Determine The Amount Invested

The first step in calculating cash on cash return is to determine the total amount invested.

The total amount invested includes everything you paid to purchase (and potentially improve) the property. In most cases, this is the down payment plus any costs associated with financing, legal fees, and capital expenses you made with cash.

Simply add all of these initial expenses to determine the actual cash invested in the property investment.

2. Calculate Annual Pre-Tax Cash Flow

The next step is to find out the total pre-tax annual cash flow from the property.

This can be done by subtracting all of the expenses associated with the property (mortgage payments including interest payments, taxes, insurance, property management, etc) from the annual income received from rents and other income collected.

The difference between income and expenses is the annual cash flow (sometimes called net cash flow).

3. Divide Cash Flow By Cash Invested

Finally, divide the annual cash flow by the initial cash invested. You can then multiply by 100 to get a percentage.

For example, if you invested $100,000 in an investment property and have an annual pre-tax cash flow of $10,000, the cash on cash return is $10,000 / $100,000 or 10%.

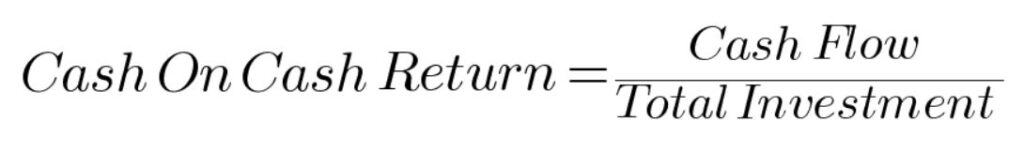

Cash On Cash Return Formula

The formula for cash on cash return is:

Annual pre-tax cash flow / Actual cash invested = Cash On Cash Return

As you can see, it’s a pretty simple calculation. Just remember to use the actual cash invested (not just the purchase price) and your annual pre-tax cash flow.

Real Estate Cash On Cash Return Examples

Let’s take a look at a few examples to see how this metric can be useful for real estate investors.

Example #1: Using Leverage

An investor buys a rental property for $100,000. They put down 20% and finance the remaining 80%. The interest rate on the loan is six percent and it is a 30-year fixed rate mortgage. The property is rented for $900 per month.

The monthly expenses associated with the property are:

– Mortgage payment: $480

– Property taxes: $100

– Insurance: $50

– Property management: $75

In this example, the annual pre-tax cash flow is (12 x $900) – ($5,760 + $1200 + $600 + $900) = $2,340.

And the cash on cash return is 11.7% (($2,340/$20,000) x 100).

Example #2: All-Cash Purchase

We’ll use the same figures in this example as in the previous. Except for this time, our real estate investor makes an all-cash purchase of the rental property for $100,000.

In this case, the annual pre-tax cash flow is (12 x $900) – ($1200 + $600 + $900) = $8,100.

And the cash on cash return is 8.1% (($8,100/$100,000) x 100).

Interesting. Without leverage, our investor makes more money but has a lower cash yield. This is one of the reasons why leverage is such a powerful tool for real estate investors.

Example #3: Improvements To The Property

Let’s say our investor decides to purchase the same property with a 20% down payment, but this time decides to put in $10,000 of improvements before the first tenant moves in. Because of these improvements, the property rents for $1,100 per month.

We’ll assume all of the same expenses:

– Mortgage payment: $480

– Property taxes: $100

– Insurance: $50

– Property management: $75

In this example, the annual pre-tax cash flow is (12 x $1,100) – ($5,760 + $1200 + $600 + $900) = $4,740.

The cash on cash return with the improvements is 15.8% (($4,740/$30,000) x 100).

In this final example, our investor increased his cash on cash return through property improvements. This won’t always be the case, and real estate investors should always run the numbers to determine whether improvements will pay off.

Factors That Impact Cash On Cash Returns

Let’s take a more in-depth look at the factors that impact this important real estate metric.

Net Operating Income

The first factor that impacts cash on cash return is net operating income (NOI). NOI is a measure of a property’s profitability and is calculated by subtracting all expenses from the annual rental income.

For example, if a property generates $36,000 in rental income per year and has $12,000 in expenses, the NOI is $24,000.

The higher the NOI, the higher the cash on cash return will be.

Annual Cash Flow

Annual cash flow is determined by subtracting any mortgage payments from the net operating income. Cash flow is the net income generated by the real estate investment.

For example, if the NOI from our above example was $24,000 and the mortgage payment was $12,000, the annual cash flow would be $12,000.

Because cash flow is the numerator in the cash on cash return equation, increasing income, reducing expenses, or reducing debt repayment will increase cash on cash returns.

Debt Service

Debt service covers the principal and interest payments of your loan. The payment amount will largely depend on how much you borrow but is also dependent on the interest rate. Negotiating a lower interest rate will increase cash on cash returns.

In addition, you may have an option for interest-only financing. With this option, you only pay the interest portion of the mortgage payment but don’t pay down any of the principal balance. This leaves you with a higher cash flow which increases cash on cash return at the expense of equity gains.

Cash Invested In The Property

The final factor that impacts cash on cash return is the amount of cash you have invested in the property. The total cash invested is typically the total purchase price (including down payment, loan fees, and escrow) plus any money used for improvements or repairs.

Since this is the denominator in the equation, lowering this number will increase the cash yield (assuming the cash flow stays the same).

This doesn’t mean you should try to invest as little as possible. Recall our example where the investor makes improvements to the property. His initial investment was greater, but it allowed him to collect more in rental income and a higher return on investment. It’s important to run the numbers for any scenario you are considering to determine the best course of action.

Frequently Asked Questions

Refinancing allows you to take out a new loan with different terms. You may be able to get a lower interest rate, which would reduce your debt service. Alternatively, you could take out a longer loan which would lower your monthly mortgage payments. Both options increase your returns because they reduce monthly expenses.

Cash Out Refinancing

Another option is a cash-out refinance. With this option, you pull equity out of the property but increase the mortgage payment. This has two effects on the cash on cash returns. First, it increases expenses which reduced monthly income. Second, it decreases the amount invested by the amount of cash pulled out.

Many investors use this strategy as a way to purchase additional rental properties using the equity they’ve built.

“Good” cash on cash return depends on your investment objectives. Most real estate investors shoot for 7-10% or more. This provides a sufficient cushion to absorb any unexpected obstacles or vacancies.

Some investors, however, lean toward building equity through appreciation and principal repayment. These investors may look for lower cash on cash return if they can build wealth faster through equity.

Cash on cash return looks exclusively at the free cash returned to the investor and ignores any equity gains. It’s useful because it shows how much an investor can use to live on.

Return on investment looks at both free cash as well as an increase in equity to provide a more comprehensive picture of the returns.

Real estate investments generate wealth in two primary ways; cash returns and appreciation. The difference is that cash returns can be used by real estate investors to cover their living expenses while appreciation is illiquid and can only be accessed through a refinance or sale of the property.

Summary

Cash on cash return is one of the most important metrics for real estate investors. It shows how much cash will be returned as a proportion of the amount invested in the property.

Aiming for higher cash on cash returns can help real estate investors maximize their returns while providing a cushion for unexpected vacancies or repairs.

Have any tips for maximizing cash on cash return? Let us know in the comments.