Real estate syndication is becoming an increasingly popular way for people to invest in multifamily properties. In a nutshell, multifamily syndication is the process of a sponsor purchasing a multifamily property (typically an apartment complex or portfolio of apartment complexes) with other investors’ money.

There’s a lot of buzz around multifamily syndication lately and for good reason. This type of investing has become very popular in recent years because it’s a great way to get into the multifamily market without having to come up with all of the cash yourself. If you’re interested in learning more about multifamily syndication, keep reading.

If you’re ready to start investing, check out our guide on the best syndications.

What Is Multifamily Syndication

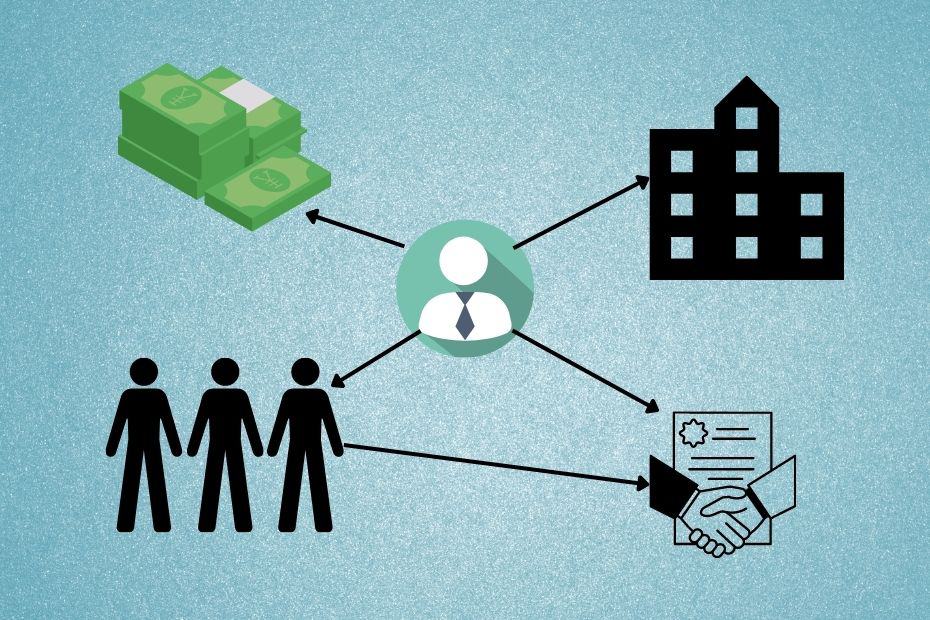

Multifamily syndication is a type of real estate investing where a sponsor (an experienced real estate investor who puts together the deal and manages the property) purchases a multifamily property with money from outside investors. The property’s cash flow and equity gains are then split between the investors and the sponsor.

Each multifamily syndication deal is structured differently, but typically, investors will put up 80-95% of the total capital needed, and the sponsor will contribute the remaining amount. Check out our resource on real estate syndication structures to learn more.

For example, let’s say a multifamily property costs $20 million to purchase and is financed with 75% debt ($15 million). The sponsor may contribute $500,000 and secure the remaining $4.5 million down payment from outside investors. These investors can come from a variety of sources including friends and family, private equity, or crowdfunding.

After purchasing the property, the sponsor handles all of the operations of the property (or hires a property management company) and distributes free cash to the investors based on the investment strategy and structure of the syndication.

How Does Real Estate Syndication Work?

Let’s dig a little deeper into how multifamily syndication works. There are basically 3 phases of each syndication which we will outline below. Roughly these phases represent the start (finding property and investors), middle (operating the property), and end (cashing out) of a syndication deal.

Origination

In this first phase, the syndicator or sponsor locates a target investment property. Each real estate syndicator has different criteria they look for in a property. They may look for a certain number of units or a specific price range. In addition, the syndicator may choose multifamily properties with value-add opportunities, or they may look for more stable investments with less growth.

Once the sponsor has identified a particular investment property, they arrange the financing. This investment comes from 3 sources.

- Debt — Similar to your mortgage debt, multifamily properties can be financed with up to an 80% loan-to-value ratio.

- Sponsor’s Investment — The sponsor typically invests a smaller amount of money into the deal. On average, this is 5-20% of the initial investment (excluding debt).

- Outside Investment — The sponsor brings on additional investors from a variety of sources. This can be friends and family, crowdfunding, or they might find investors through their bank. The outside investors fund the remaining majority of the initial investment.

In some cases, the sponsor may use short-term debt or bridge loans to cover the initial outside investment. This reduces the risk during the closing of the investment property — the sponsor isn’t waiting for multiple investors to fund their investment.

While the syndicator is arranging the financing for the real estate deal, they are also performing due diligence on the property to ensure it’s a solid investment and will meet their investing goals and expectations.

After the sponsor has arranged all the funding and debt for the property, they execute the property’s purchase and set up the property management. This marks the end of the origination phase.

Operation

During the operation phase, the sponsor’s main focus is on increasing the value of the multifamily property. There are a couple of different ways that multifamily syndicators do this.

The first way is by increasing the net operating income (NOI). This can be done by making improvements to the property or by lowering expenses (through negotiating lower costs from vendors for example).

The second way is by increasing the value of the property through appreciation. This can be done by making improvements to the property or waiting for the market to improve in the area.

Passive investors can expect to receive payments as a portion of the free cash flow generated by the rental property. Typically this will be based on the amount invested by each individual investor (assuming the cash flow can support the payouts). For example, the returns for a specific deal might be 6% annually or 0.5% per month.

As the name implies, passive investors simply collect passive income. The operation of the investment property lies solely in the hands of the real estate syndicate.

Liquidation

The liquidation phase is when capital is returned to the investors. This happens either through the sale or refinancing of the investment property.

Each real estate syndication deal has unique rules regarding how the capital returns are split among the sponsor and limited partners. Typically the split is expressed as a percentage share. For instance, it might be a 70/30 split where 30% of the proceeds go to the sponsor and the rest is split among the limited partners based on their equity share. Or it might be an 80/20 split — it just depends on the individual deal.

If the liquidation event results in the sale of the investment property, the syndication is most often terminated. However, in the case of refinancing, the operation phase continues until the asset is eventually sold.

Components Of Real Estate Syndication

Now that we’ve covered the basics of multifamily syndication deals, let’s take a more in-depth look at each component of a deal.

Investment Property

The investment property is the multifamily asset that is being purchased by the syndicator. This can be an apartment complex or a portfolio of multifamily properties.

The investment property must have certain characteristics in order for it to be attractive to potential investors. For instance, it should be located in a high-growth market with strong demographics. Additionally, the property should have a solid historical performance and be well-maintained.

The investment property is often the most important component of the multifamily syndication deal because it will determine the success or failure of the investment.

Debt

Debt is often used in multifamily syndication deals in order to leverage the investment. This can be done through a variety of methods, such as loans, lines of credit, and mezzanine financing.

The use of debt can help to increase returns for investors while lowering the amount of capital from the pool of investors and allowing the investors access to bigger real estate deals.

However, it is important to note that the use of debt can also increase the risk of the investment. Therefore, it is important to carefully consider the amount of debt that is used in a multifamily syndication deal.

Debt for multifamily properties is similar to the mortgage you may have on your home. The most notable difference is that the loan for multifamily real estate is often a non-recourse loan. This means in the event of a default on the loan, the bank cannot go after other assets of the general partners or the limited partners. This stipulation is offset by a slightly higher interest rate to reduce the risk the bank takes on.

General Partner (Sponsor)

All real estate syndications have a sponsor (also called the general partner). Depending on the size of the real estate investment, there may be multiple general partners.

The sponsor is the person or entity that finds the investment property, puts together the deal, sets up a limited liability company, manages, and finally sells the asset. The sponsor is also responsible for putting up a portion of the capital for the multifamily syndication deal.

The amount of money that the sponsor invests varies depending on the size of the multifamily property and the amount of leverage that is being used. However, it is not uncommon for a sponsor to invest 20-30% of the total capital required for multifamily syndications.

The sponsor typically receives a higher percentage of the cash flow (up to 50%) than the limited partners because they are assuming more risk. They also usually receive various fees for putting together and managing the real estate investment.

Limited Partners (Passive Investors)

The limited partners are the passive investors in a multifamily syndication deal. They provide the capital for the investment and receive a percentage of the cash flow and profits when the property is sold.

The limited partners are typically accredited investors. An accredited investor is any individual with a net worth of over $1,000,000 or an annual income of over $200,000, or a joint couple with a $1,000,000 net worth and income over $300,000. In either case, the income requirement must be met for 2 consecutive years. The SEC created this rule to protect investors because multifamily syndications are considered high-risk investments.

While the limited partners are considered to be passive investors, they still have a say in how the multifamily property is managed. This is done through the operating agreement that is signed when they invest.

Operating Agreement

The operating agreement is a legally binding contract between the sponsor and the limited partners that outlines the rights and responsibilities of both parties. It is important to have a well-written operating agreement in place in order to avoid any misunderstandings or conflicts down the road.

The operating agreement should include information such as the distribution of cash flow, profits, and losses. It should also detail any fees charged by the syndicator.

It is important to have an attorney review the operating agreement before signing it. This will ensure that everything is in order and that you understand all of the terms and conditions.

Fees

Each multifamily syndication investment creates a unique fee structure. While these can range in the types and amounts of fees, here are the most common fees you should expect to see in multifamily syndications.

- Equity Origination Fees are charged when a passive investor puts money into a deal. Typically this runs 1-3% of the money you invest and is paid when you first invest in the property. Alternatively, the syndication may call this an acquisition fee and charge 1-5% of the purchase price of the property. Acquisition fees are paid to the sponsor out of the syndication funds — you don’t directly see this fee, but it’s there.

- Asset Management Fees are paid to the syndicator typically monthly and are a percentage of the gross monthly rental income produced by the multifamily property. The asset management fees are intended to compensate the sponsor for their work managing the asset (handling the financials and distributions, working with the property management team). This is different from the property management fees which cover the cost of managing the day-to-day operations of the property.

- Refinance Fees typically range from 0.5-2% of the cost of the new loan amount when refinancing. This fee is designed to compensate the sponsor for the work in negotiating and obtaining a new loan.

- Disposition Fees are charged when the property is sold. These fees may run from 1-2% of the sale price of the property. This fee covers the cost of the sponsor to shop the property around to potential buyers and negotiate for the highest price. This fee is in addition to any real estate agent transaction fees.

In addition to these common fees, you might encounter others such as Construction Management Fees for managing construction or improvements to the property, Loan Fees for obtaining the original financing, or Loan Guarantor Fees to compensate a general partner for securing the loan with their personal assets.

Returns

The returns from multifamily syndication investing come through 2 primary vehicles; return of equity and cash flow.

Return Of Equity

Multifamily properties increase equity in two primary ways. The first way to increase equity is through appreciation or an increase in the market value of a property. Because the value of a multifamily property is determined by its Net Operating Income, increases in monthly rent or decreases in expenses can raise the property value.

The second way to increase equity is through debt paydown. Just like paying down mortgages on single-family properties, paying down the debt on a multifamily property increases equity.

So, how is this equity returned to the partners in multifamily syndication?

Multifamily real estate investments return equity to their investors through either cash-out refinancing or through the sale of the property.

Cash Flow

Real estate investors enjoy a portion of the free cash flow returned from the operation of the real estate investment. Typically this is a percentage of the investment (assuming the property is generating sufficient free cash).

For instance, the operating agreement might specify the first 4% or 6% of the free cash gets distributed to the passive investors. If the property generates more cash, the remainder might be split among all partners based on equity share.

While each syndication is different, most distribute cash flow to their investors monthly or quarterly.

Pros And Cons Of Real Estate Syndication

Now that we’ve covered how multifamily investing works, let’s take a look at some of the benefits and drawbacks.

5 Benefits Of Multifamily Syndications

- Tax Efficiency — Real estate investors love their investment decisions because of the numerous tax benefits. The primary benefit is reduced taxes on distributions due to depreciation. Many real estate investors enjoy a 0% tax rate, especially in the first few years.

- Diversification — Investing in real estate, particularly multifamily real estate investing is something many investors don’t do. Adding multifamily investments to your portfolio will add a new asset class.

- Inflation Hedge — Since the value of multifamily real estate is based primarily on the net operating income, any inflation of rent prices will add value to real estate investments.

- Access To Larger Deals — Multifamily syndication offers investors access to much larger properties than they could purchase themselves. Many investors can purchase single-family properties, but don’t have the cash to invest in multifamily. Syndications offer the chance to invest in larger assets.

- Completely Passive Investment — As a limited partner in a syndication, you don’t have any responsibilities. You can put in your investment up front and collect monthly income through preferred returns.

4 Drawbacks Of Multifamily Syndications

- Illiquidity — In general, real estate syndications are not liquid assets. You will have your money tied up for the duration of the syndication which can last years or decades.

- Lack Of Control — While passive investors provide the capital to purchase large multifamily properties, the real estate syndicators typically maintain full control of the decisions and operation of the property.

- High Barrier To Entry — Not just anyone can invest in syndications. The SEC requires multifamily syndication investors to be accredited investors. This means you either have to have a high income or a high net worth to access multifamily syndications.

- Fee Structure — Each syndication has a different fee structure. We covered the different fees you might find, but one thing to consider is how the fees reward the syndicator. Is the syndicator incentivized to grow the value of the property or are they incentivized to flip properties for little gain? You’ll want to find a syndication that aligns both your and the syndicator’s financial success.

How To Invest In Multifamily Real Estate Syndication

Now that we know what multifamily syndication is and how it works, let’s discuss how you can actually get started investing in multifamily real estate.

There are many crowdfunding sites that cater to multifamily investing. Sites like CrowdStreet, FundRise, EquityMultiple, and many more offer syndicated multifamily real estate for accredited investors. Some of these sites even have options for non-accredited investors. For a comparison of the different platforms, check out our post on the best real estate syndication companies.

Each of these sites lists its offerings for you to choose from or you can invest in a fund deal that holds equity across several of their properties.

One drawback of these crowdfunding sites is the investment minimums. While some offer lower minimum investments like $500 or $1,000, others have higher minimums between $10,000 and $25,000.

Multifamily Real Estate Syndication Compared To Other Types Of Real Estate Investing

Let’s take a look at how multifamily real estate syndication compares to other types of real estate investing.

Syndication vs. REITs

While syndications allow you to own equity in the actual multifamily investment opportunity, REITs (Real Estate Investment Trusts) are companies that own real estate. Investing in a REIT is owning shares of that trust.

REITs offer some additional diversification because they typically invest in many properties whereas syndications typically invest in a single property or a small portfolio of properties.

REITs also offer more liquidity because you own shares in a company rather than equity in a business.

Syndications, on the other hand, can offer better returns and they pass on the tax benefits to the investors.

Syndication vs. Crowdfunding

It’s a misconception that real estate syndication and crowdfunding are different types of real estate investments.

Syndication is a type of business structure that allows passive investors to own a stake in larger real estate assets.

Crowdfunding is simply a method syndicators may use to find investors for their deals. As the name implies, the funds are raised from a crowd or pool of individual investors.

Syndication vs. Real Estate Investment Funds

Real estate investment funds are similar to multifamily syndications in that they offer passive investors a way to own equity in large multifamily properties.

The key difference is that with real estate investment funds, you’re investing in a fund rather than a specific property. This offers more diversification because the fund may hold equity in several multifamily properties.

Real Estate Investment Funds are more similar to REITs except that a REIT is a corporation that invests exclusively in real estate while a Real Estate Investment Fund is more similar to a mutual fund.

FAQs

Multifamily real estate is a real asset that provides multiple housing units which are rented to unique households. Compared to single-family homes, multifamily homes offer investors lower expenses due to multiple rental units sharing a single building.

Compared to investing in single-family properties, multifamily properties offer the potential for higher returns due to economies of scale. This is because multifamily properties have lower expenses due to multiple rental units sharing a single building. Multifamily real estate investors may also be able to take advantage of certain tax benefits not available to other types of investors. Finally, multifamily properties are often less volatile than other types of real estate investments.

The risks of multifamily real estate include vacancy risk, lease term risk, and interest rate risk. These can be mitigated by diversifying your investment portfolio across different geographical locations and property types.

Many equity-based syndications are open only to accredited investors, however, some syndicators open debt-based investment opportunities to non-accredited investors.

A typical syndication deal is organized as an equity share. This means that both the syndicator and the investors own a portion of the company or fund. The property is owned by the company or fund.

Multifamily real estate syndications typically use debt financing in the form of a commercial mortgage. This is because multifamily properties tend to have high initial costs and require a large amount of capital. Typically these commercial loans have shorter terms than traditional mortgages, however, syndicators typically refinance before the end of the terms.

Summary

Multifamily syndication is a great way for real estate investors to get into the multifamily market. By pooling resources with other investors, you can purchase multifamily properties at a lower cost and enjoy the benefits of economies of scale and earn passive income.

However, it’s important to remember that multifamily real estate is a long-term investment and there are risks involved. Be sure to do your research and consult with a financial advisor before making any investment decisions.

What questions do you have about multifamily syndication? Let us know in the comments.