If you’re investing in real estate, chances are you already know that depreciation provides a great benefit by reducing your taxes. You probably see a big reduction in your taxable income from your rental properties every year because of deprecation. It probably makes you feel good seeing how much money you’re saving.

Depreciation is one of the biggest draws of real estate investing. Many people invest in real estate as a means to lower their income tax. It makes sense. Wouldn’t you rather keep as much of your hard-earned money as you can?

In this article, we’ll walk through an example real estate investment scenario, graph the tax benefits from deprecation, and explore a few strategies to defer taxes indefinitely.

What Is Depreciation In Real Estate Investing?

Investopedia defines real estate depreciation as “the process used to deduct the costs of buying and improving a rental property”.

When any business purchases an asset with a useful life of longer than a year, the IRS requires that to be depreciated over a set timeline instead of deducted in the year the expense occurred. For most assets, this makes sense; by the time the asset is used up or worn out, it has no value and its full value has been deducted through depreciation.

Real estate is a little different. The value of real estate grows over time. It does not get used up or worn out. This is one of the main reasons real estate is a popular investment — it appreciates in value and provides cash flow while reducing taxes.

Because of this difference, I like to think of real estate depreciation as a deferment in taxes. The IRS allows you to reduce the asset value over 27.5 years. However, the actual value of the asset isn’t going down; it’s increasing (hopefully). When you decide to sell your property, you will pay taxes on the difference between the sale price and the asset value which has been reduced through depreciation.

So you will have to pay back the taxes you deferred through depreciation… eventually… or maybe never?!?! We’ll take a look at that later.

But first, let’s go over some assumptions in our hypothetical real estate investment scenario.

Assumptions In This Scenario

For this hypothetical scenario, we are going to purchase a single-family home (though this analysis works regardless of the size of the asset).

- Purchase Price: $250,000

- Loan: $187,500 (75%) at 4% interest

- Yearly Mortgage Payment: $10,843

We will assume the building accounts for $200,000 of the purchase price. Using 27.5 years of depreciation, this will provide a yearly depreciation of $7,273 (we’ll round off to the nearest dollar in our example). If you’re interested, we put together a guide to calculating real estate depreciation that can explain how we got to this number.

We’ll also make some assumptions about the rent price and rental market.

- Initial Monthly Rent: $2000

- Occupancy Rate: 95%

- Rental Appreciation: 5% yearly

And a few more assumptions regarding the costs of maintaining the property and a marginal tax rate.

- Expense Ratio: 50% (including property taxes, insurance, utitilities, etc).

- Marginal Tax Rate: 24%

We will also assume that you can’t use any tax loss from the rental property to offset other income. Instead, we will roll over any tax loss to the next year and deduct it from future rental income.

Depreciation At The Beginning Of The Real Estate Investment

In the first year, we will make a small amount of money. But only because of depreciation. If we don’t factor in depreciation, we end up with a net loss after paying taxes. This can happen because a large chunk of our income goes to the mortgage payment. We get a tax deduction for the interest, but not for the principal repayment.

Here are the numbers in the first year.

- Gross Income: $22,800

- Mortgage Payment: $10,843 ($7,500 interest, $3,343 principal repayment)

- Expenses: $11,400

This leaves us with a net income after financing of $557. Not bad for the first year. At least we have a small profit.

Now, let’s take a look at the taxation of this income. Remember that the $557 includes a reduction for the principal repayment, but that doesn’t apply when calculating the tax liability. So, our taxable income is quite a bit higher.

- Taxable Income (without depreciation): $3,900

- Tax Liability (without depreciation): $936

- Net Profit (without depreciation): -$379

Oh no, we have to pay more in taxes than we made. This is where depreciation steps in to preserve our profits. In this first year, the $7,273 depreciation more than compensates for the $3,343 of principal repayment that doesn’t count against our taxes.

- Taxable Income (with depreciation): -$3,373

- Tax Liability (with depreciation): $0

- Net Profit (with depreciation): $557

Yes! We keep all of our profit in the first year.

Why is this? Recall that we don’t get to count the $3,343 of principal repayment against our taxable income, but we do count it against our net income after financing. So, our taxable income is quite a bit higher than our net income after financing. Deprecation, in this first year, is almost double the principal repayment so it effectively reduces our taxable income below zero.

If our taxable income is less than zero, don’t we get to deduct it from other income? Yes, we do. In some cases, we can deduct this from income from other sources. That’s not always the case, so we will deduct this from rental income in future years.

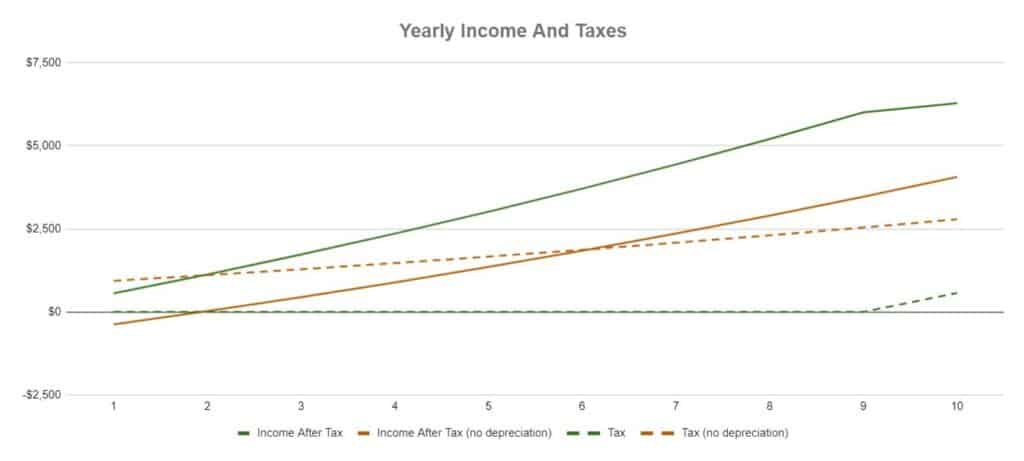

Let’s extrapolate this over a few years assuming appreciation in the rental income. In the graph below, we can see that we will consistently keep more profit every year due to depreciation. And, with depreciation, we won’t end up owing any taxes for the first 9 years.

In the first 10 years, we would have paid an extra $18,023 in taxes if we didn’t get to account for depreciation. Now that’s a huge saving.

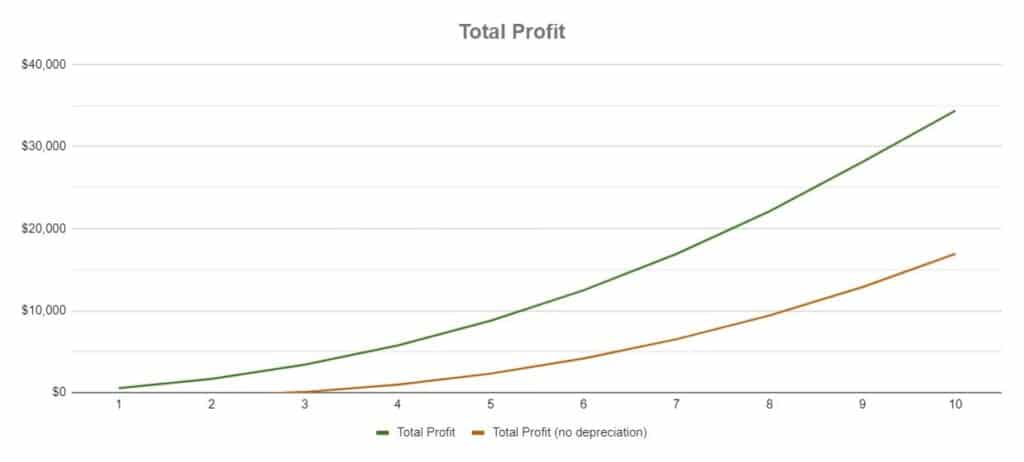

Let’s take a look at this from a different angle. The graph below shows the total profit we have after a certain number of years of ownership. If we owned the property for 10 years, we would have made a profit of $34,388 with depreciation but only $16,934 without it.

The Crossover: Finally Owing Taxes

In our example, we get to collect rental income for the first 9 years without paying any taxes. But what happens after that? Does depreciation still provide the same benefits?

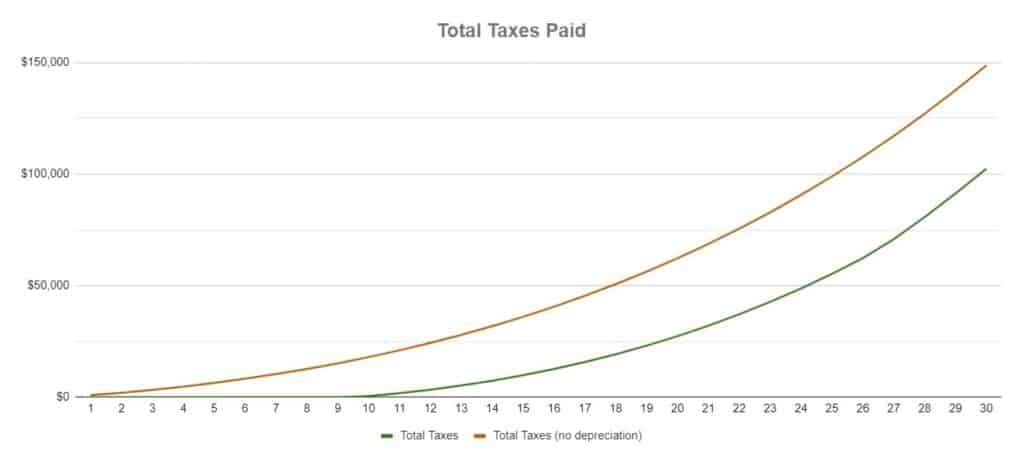

The answer is yes, depreciation still continues to reduce our tax bill for the full 27.5 years we claim it. Let’s take a look at the total amount of tax we’ll pay if we owned the property for 30 years.

After 30 years, we would have paid $148,706 in taxes without depreciation, but only $102,452 with depreciation. That’s a savings of $46,254. Now that’s a good chunk of change!

If we extrapolate the profit from the previous section, we see the same thing. With depreciation, we have a total profit of $329,657. Without depreciation, we would only have $283,403. The same difference of $46,254.

Downside To Real Estate Depreciation

So depreciation is all rainbows and unicorns, right? Not exactly. The US government does want us to pay taxes on any gains we have when we choose to sell the rental property. Like any other asset, the IRS expects us to pay taxes on the difference between the sale price and the purchase price.

So how does depreciation factor into the sale of a rental property?

Any amount of depreciation claimed in the years we owned the rental property must be deducted from our purchase price or cost basis when we sell the property. This increases the difference between the sale price and cost basis which increases our tax liability. In effect, we must repay the benefits we received while claiming depreciation. This is called depreciation recapture.

The good news is that the sale of a rental property is typically taxed at capital gains rates while the depreciation we claimed reduced our tax liability at ordinary income rates. This means we will likely be taxed a lesser amount when we sell the property than the benefits we received while owning the property.

Deferring Taxes on Rental Properties

What if there was a way to defer the taxes on our rental property? Recall that, in our example scenario, we enjoyed 9 years of tax-free income, but had to start paying taxes in the 10th year. What caused us to have to start paying taxes at that time?

While we deducted depreciation from our taxable income every year, we also have 2 factors that increase our taxable income every year. The first is rental appreciation. Over time rent prices go up and we earn more money per year. The second is a reduction in mortgage interest. As we pay down the loan, we pay less in mortgage interest so our tax deduction from this interest gets smaller every year.

In the first few years of operation, we showed the IRS a net loss in our taxable income. We got to keep that loss as a credit to deduct against future income from the rental property. Once we started having a net gain in taxable income, we reduced the gain to zero for a few years by using up that credit. Once the credit was used up in year 10, we had to start paying taxes.

So, there is a trend we can draw. The first few years have a net loss that we can deduct, then we reclaim the net loss before paying any taxes.

What if we decided to purchase another rental property? The IRS wants us to aggregate the income from our rental properties. Since the first few years of this new property have a net loss in taxable income, it offsets any net gains from the first property.

If we keep acquiring rental properties, we can play this trick indefinitely; using the net loss from the new properties offset the net gain from the older properties.

But how can we reduce the tax burden of the depreciation recapture? There are 2 ways we can avoid depreciation recapture. The first is through a 1031 exchange, also called a like-kind exchange. Using the 1031 exchange allows us to swap one real estate investment for another and, critically, push the capital gains from the first property to the new property. We can do this again when we want to sell the new property; again pushing the capital gains from the first two properties onto the second. There is no limit to the number of times we can do this.

The second method to avoid depreciation recapture is through death. I know, it’s morbid, but it allows us to pass our real estate investments to our children without incurring any taxes. When we pass our rental properties to our children in this way, our children get to “step up” the cost basis. This means the cost basis is reset to the value of the investment at the time of our death.

Now, what happens when we combine these 2 strategies? First, we can defer all of our capital gains taxes, including depreciation recapture, until we die. Then we pass the investments to our children and effectively wipe away that capital gain.

Wow!! That sounds too good to be true, but it’s all covered in the tax code here and here.

Summary

Depreciation allows real estate investors a large tax deduction while operating rental properties. As we saw in the example scenario, we were able to get 9 years of tax-free income from a rental property. And after that, we still paid reduced taxes until the depreciation ran out after 27.5 years. Depending on your income and marginal tax rate, this can net huge savings for real estate investors.

Beyond the tax deductions during operation, real estate investors can indefinitely defer depreciation recapture and taxes on their rental properties using 1031 exchanges and the step-up basis. This is one way the wealthy build generational wealth for their children and grandchildren.

Do you have any tips on real estate depreciation or taxes? Let us know.