Looking for the best real estate syndication company can be a daunting task. With so many investment opportunities available, from multifamily apartment buildings to offices and land, and from private equity to crowdfunded real estate, it can be hard to decide which syndication is right for you. In this guide, we will help you narrow down your options and find the best real estate syndication for your needs!

Choosing a real estate syndication platform can be a daunting task. We’ll help you decide by looking at the top platforms and companies and comparing these key factors.

- Access for non-accredited investors.

- The minimum investment.

- The types of real estate investments that are offered.

- The fee structure.

- Average annual returns.

In addition to direct investments in real estate deals, many of these platforms offer real estate funds. We’ll take a look at these offerings as well.

If you want to learn more about how real estate syndication works, check out our resource on multifamily syndication.

Best Real Estate Syndication Companies And Platforms

1. Fundrise

Founded in 2012, Fundrise aims to use technology to make high-quality, low-cost real estate investing available to everyone. With minimum investments as low as $10 and asset management fees capped at 0.85%, we’d say they’re meeting these goals.

How does Fundrise make real estate investing open to everyone?

It’s simple. They offer access to funds that invest in different real estate syndications and properties. With these funds, you’ll have access to a broad range of property types as well as varying levels of risk and reward.

Can I invest directly in syndications through Fundrise?

Yes, however, you must be an accredited investor with a $100,000 minimum investment.

Highlights:

- Minimum Investment: $10 for access to real estate funds, $100,000 for direct access to syndication deals.

- Average Annual Returns: Around 12%.

- Allows Non-Accredited Investors: Yes, for real estate fund investments. Access to syndication deals is available for accredited investors only.

- Fees: 0.15% annual investment advisory fee plus up to 0.85% annual asset management fees.

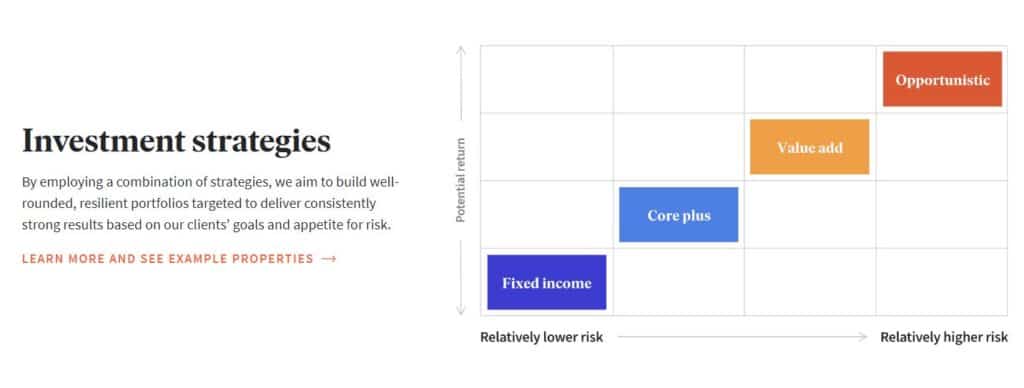

- Investment Strategy: Offers a range from low-risk fixed income to high-risk value-add and opportunistic investments.

- Number Of Active Investors: More than 330,000.

- Transaction Volume: $7 billion.

What Fundrise Invests In:

- Single-Family

- Multifamily

- Office

- Industrial

- Other

Fundrise Returns:

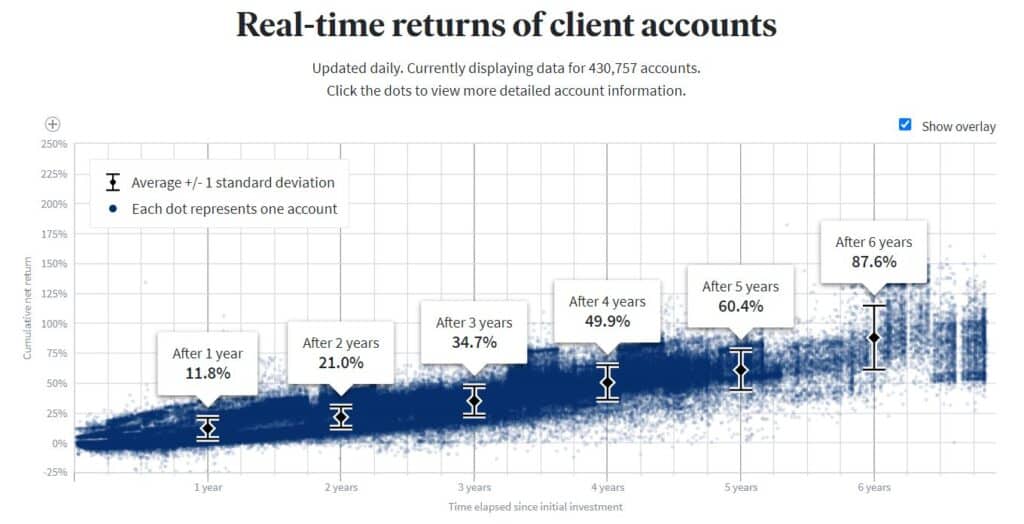

Because Fundrise invests in so many different types of real estate investments across a broad range of risk, looking at the average returns is somewhat misleading.

However, Fundrise has a nice chart showing all of their investors’ returns over the last 6 years.

Looking at this chart, we can see the average returns are around 12%. Remember that your actual performance will vary depending on your individual investments.

2. EquityMultiple

EquityMultiple focuses on finding the best real estate investments on the market. From an exclusive deal flow to a strong due-diligence process, EquityMultiple is very selective in its offerings.

Once it has an asset under management, you can be confident in EquityMultiple’s industry experience looking after the property and maximizing investors’ returns.

EquityMultiple offers a few different methods of investing in commercial real estate from debt to equity in individual properties to fund investments. It also offers a choice of preferred or common equity to focus on either reliable cash flow or long-term appreciation. Choosing an option really comes down to your personal investment strategy and goals.

Highlights:

- Minimum Investment: $5,000 for short-term debt investments, $10,000 for equity investments, and $20,000 for fund investments.

- Average Annual Returns: 18.7% IRR per the company’s website.

- Allows Non-Accredited Investors: No.

- Fees: 0.5% to 1.5% for all types of investments.

- Investment Strategy: Focused on strong cash flow combined with long-term appreciation potential.

- Transaction Volume: $4.33 billion.

What EquityMultiple Invests In:

- Single-family (condo/townhomes)

- Multifamily

- Office

- Industrial

- Mixed-use

- Other

EquityMultiple Returns:

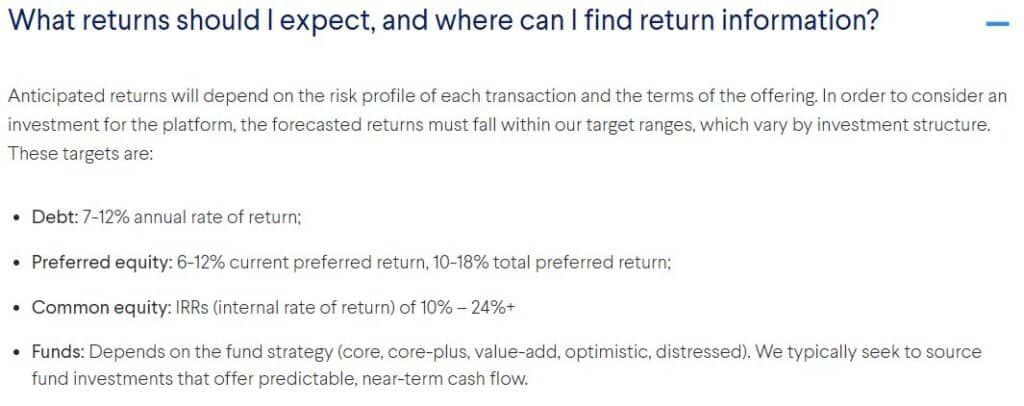

Per its website, EquityMultiple advertises an 18.7% rate of return. However, this is the aggregate across all of their investment products. EquityMultiple has different investment options across the capital stack that have different return profiles.

3. CrowdStreet

CrowdStreet offers the broadest array of commercial real estate projects. From student housing to self-storage and medical offices, CrowdStreet has more investment options for you to choose from.

CrowdStreet also provides many options across the risk/reward spectrum. Whether you’re looking to find a stable, income-producing asset for your retirement or looking to add some risk with great upside potential to your portfolio, CrowdStreet has options for you.

What sets CrowdStreet apart is its industry experience and marketplace technology. The team at CrowdStreet looks across many segments in commercial real estate to find the best investment opportunities before giving access to investors via their marketplace.

Highlights:

- Minimum Investment: Generally $25,000, but varies per offering.

- Average Annual Returns: 18.7% per the company’s website.

- Allows Non-Accredited Investors: No.

- Fees: Varies per offering, generally 0.5% to 2.5% management fees.

- Investment Strategy: Covers the full spectrum of commercial real estate offerings to provide unique risk/reward profiles.

- Transaction Volume: $3.7 billion.

What CrowdStreet Invests In:

- Multifamily

- Senior Living

- Student Housing

- Medical Offices

- Self-storage

- Industrial

CrowdStreet Returns:

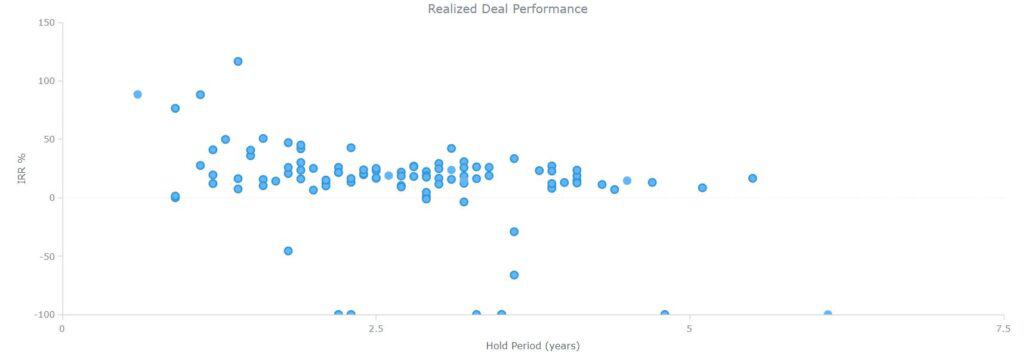

CrowdStreet offers a spectrum of risk and reward from stable, income-producing properties to value-add and opportunistic investments. With each of these types of investments comes a different risk/reward profile. If you’re looking for a stable place to invest your cash, then you can expect lower returns. Likewise, if you want to take on some risk in your portfolio, CrowdStreet has offerings for you.

CrowdStreet doesn’t break down the expected returns for each type of investment but claims an aggregate of 18.7%. They also show this interactive chart that breaks down the expectations and actual performance of their past offerings.

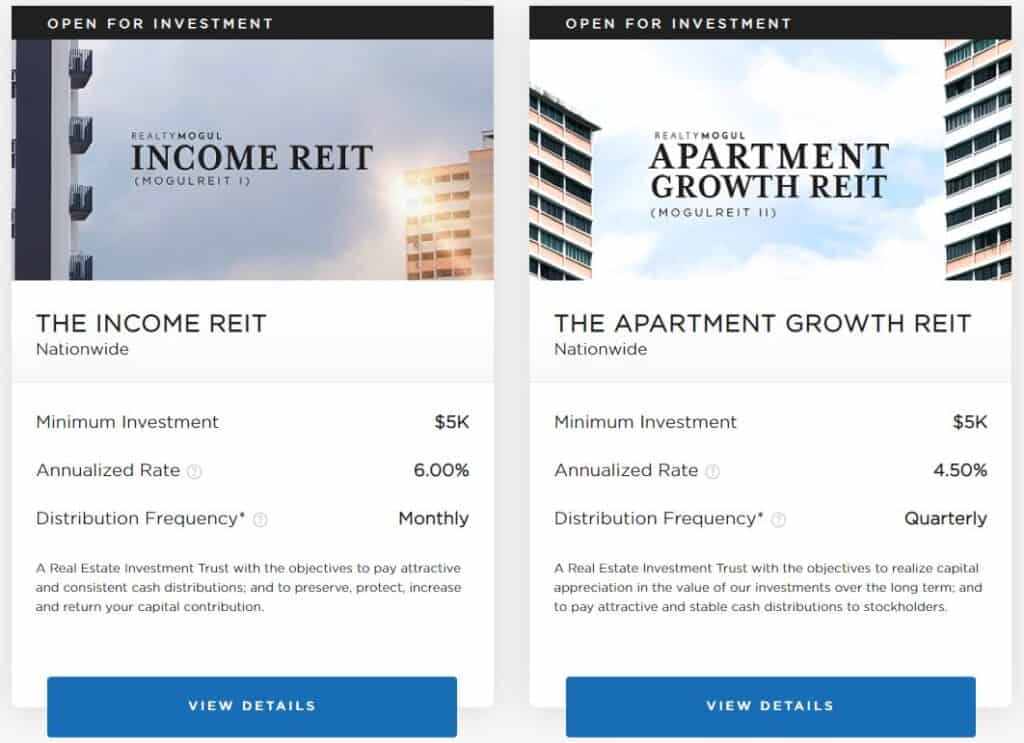

4. RealtyMogul

RealtyMogul was founded on the same investing principles used by high-net-worth individuals. They aim to bring institutional quality commercial real estate investments to the general public.

RealtyMogul focuses on cash-flowing assets to provide a stable income for its investors. This is one of the key aspects of investments that high-net-worth individuals look for. And it’s the key to generating passive income.

With RealtyMogul, you get access to their exclusive individual offerings. If you want a more diversified portfolio, they also offer REITs that focus on either regular passive income or growth.

REITs have a couple more advantages. First, they are available to non-accredited investors. And second, they have a lower minimum investment. They might just be the perfect opportunity if you’re just getting started investing.

Highlights:

- Minimum Investment: $5,000 for REITs or $25,000 for individual deals.

- Average Annual Returns: Varies per offering.

- Allows Non-Accredited Investors: Yes, through REITs.

- Fees: Varies per offering, generally 1% to 1.25% management fees.

- Investment Strategy: Provide access to institutional quality cash-flowing investments.

- Number Of Active Investors: Over 212,000.

- Transaction Volume: $5.7 billion.

What RealtyMogul Invests In:

- Multifamily

- Office

- Retail

- Industrial

- Mixed-use

- Self-storage

- Cold storage

- Mobile home parks

RealtyMogul Returns:

Like most of the other entries in our list, RealtyMogul is a platform that offers access to an assortment of deals. So, the returns depend a lot on your individual investment choices.

Unlike some of the others, RealtyMogul doesn’t make any statements on the average returns. However, browsing their open and past offerings shows quite a spectrum of returns from negative returns to over 100% IRR.

RealtyMogul also focuses on cash flow, and you can see that in its offerings. Investment opportunities range from about 5% to 8% cash-on-cash returns.

5. YieldStreet

YieldStreet aims to bring the world of alternative investments to the average investor. Historically, access to these alternative investments has been reserved for the wealthy and well-connected. Not anymore. With YieldStreet, you can choose investments from real estate to art, transportation, venture capital, and cryptocurrency.

The largest selection of offerings is in the real estate space which is likely why you’re reading this review. However, we like the option to have all of your alternative investments in one place.

If you want exposure to these alternative investments, including real estate, YieldStreet has created the Prism Fund which includes portions of all of their investment alternatives.

One drawback, however, is that most of the equity investments in real estate are not individual deals. Rather, YieldStreet has a lot of fund offerings.

Highlights:

- Minimum Investment: $5,000.

- Average Annual Returns: 9.61%.

- Allows Non-Accredited Investors: Yes, but only for REITs and the YieldStreet Prism Fund.

- Fees: Up to 2.5%

- Investment Strategy: Bring access to alternative investments to the public.

- Number Of Active Investors: Over 400,000.

- Transaction Volume: $4 billion.

What YieldStreet Invests In:

- Multifamily

- Single-family

- Office

- Industrial

- Short-term debt

- Art

- Transportation

YieldStreet Returns:

YieldStreet claims an IRR of 9.61% on their website across their real estate investments. This looks a bit lower than the other options on this list, but this is primarily due to a large portion of their real estate offerings being debt investments.

When we dug into their equity offerings, the target IRR was much larger at around 15-20% which is in line with most other platforms.

Since YieldStreet offers more alternative investments, they also break down the returns by asset class.

6. Cadre

Backed by some of the biggest names in the financial industry, Cadre offers access to some of the best commercial real estate syndication deals. Cadre focuses on its clients first by finding and offering the best real estate investment opportunities.

How do we know they do this? Institutional investors put their money with Cadre. If the smart money trusts it, that’s a sign Cadre is living up to its promises.

Cadre offers a product range from individual real estate syndication deals to funds. All of their offerings pair long-term appreciation with cash flow; the perfect combination for most real estate investors looking for stable investments.

Cadre also provides access to the secondary market. This is a unique proposition among real estate crowdfunding platforms because it gives some liquidity to investors. It gives you the opportunity to buy and sell investments outside of the initial offering.

Highlights:

- Minimum Investment: $25,000.

- Average Annual Returns: 27.5%

- Allows Non-Accredited Investors: No.

- Fees: 1.5% annual asset management fee plus 0.5% initial administration fee.

- Investment Strategy: Bring institutional-class real estate investments focusing on asset appreciation and cash flow generation to the everyday investor.

- Transaction Volume: $5.02 billion.

What Cadre Invests In:

- Multifamily

- Office

- Hotels

- Industrial

Cadre Returns:

Cadre boasts the highest rate of return at 27.5% of all the real estate syndication platforms. How do they achieve this? Cadre brings together industry experience, technology, and the best operators around the country to cultivate the best real estate investments for their clients.

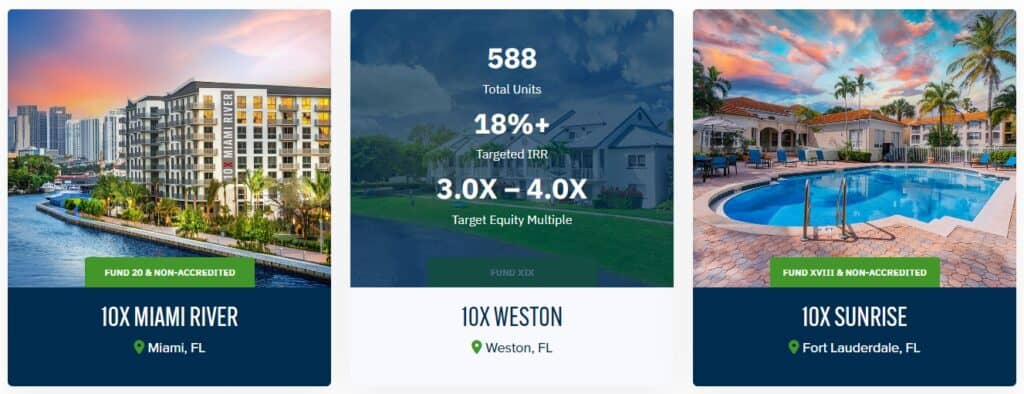

7. Cardone Capital

Grant Cardone, the founder of Cardone Capital has a true rags-to-riches story. From being a drug user at 25 to founding multiple businesses, this man knows how to make success.

Along his journey, he wondered what to do with the cash he was accumulating from his businesses. And that’s when he started investing in multifamily real estate.

As he grew his portfolio, he started offering investments to family and friends, and finally opened it up to the public with Cardone Capital.

Grant Cardone has an inspiring story and he wants to help the average investor achieve success. Cardone Capital is the only real estate syndication company that offers direct access to individual deals to non-accredited investors. It’s expensive for him to set up these deals, but he truly believes everyone should be able to invest in this class of real estate.

Cardone Capital keeps its operations simple and focuses on the 4 main points of real estate investing.

- Finding deals

- Purchasing deals

- Operating deals

- Selling deals

At its core, that’s what real estate investing is and Cardone Capital doesn’t want to complicate it.

Additionally, Grant Cardone believes the best real estate investments reward investors over a long time horizon. While many syndicators operate deals for 3-5 years, Cardone Capital holds for 10 years or longer. Grant Cardone believes in holding real estate forever. The downside to the longer holding periods is illiquidity, but when your investments produce strong cash flow, is that such a bad thing?

Highlights:

- Minimum Investment: Generally $5,000 for non-accredited investors and up to $100,000 for accredited investors.

- Average Annual Returns: Around 15%.

- Allows Non-Accredited Investors: Yes

- Fees: 1% annual asset management fee plus 1% transaction fee for the purchase and sale of the property.

- Investment Strategy: Long-term real estate ownership in stabilized properties that produce both appreciation and cash flow.

- Number Of Active Investors: Over 11,800.

- Transaction Volume: $4 billion.

What Cardone Capital Invests In:

- Multifamily

- Office

Cardone Capital Returns:

Cardone Capital doesn’t publicly disclose the actual returns on their offerings, but they do provide targets for open offerings. In general, the targets for returns are around 15%.

One of the significant benefits of investing in a real estate syndication deal is the cash flow. Cardone Capital provides this to its investors with a 6% preferred return on most of their deals.

FAQs

Real Estate Syndication is a method of real estate investing that pools money from investors to purchase a larger property, typically apartment buildings or commercial office space. Each real estate syndication deal has a sponsor who manages the property. Investors have an equity share in both the value of the deal and the cash flow.

Investing in a real estate syndication has several benefits. First, the average investor can gain access to larger investments like large apartment complexes. Second, real estate syndications offer investors diversification and protection against inflation. And lastly, real estate syndications provide an investment option with strong cash flow potential.

Real estate crowdfunding is a method syndicators use to bring investors into a real estate syndication deal. Put simply, real estate crowdfunding is one way syndicators can raise capital for their real estate deals.

Real estate syndications do charge some fees. Typically there is an asset management fee as well as transaction fees (initial investment, refinance, sale). If you are investing in funds that purchase syndication deals, the fund sponsor will also typically charge a fee on top of the syndication fees. In most cases, these fees range from 0.5% to 2% each. Learn more about how real estate syndications are structured.

Absolutely. Real estate syndications offer many benefits to their investors. From high cash distributions to long-term appreciation and hedging for inflation, investors can diversify their portfolios by adding real estate into the mix.

Summary

When it comes to finding the best real estate syndication company for you, there are a lot of things to consider. Each company has its own investment strategy and fee structure, so it’s important to do your research before investing.

That being said, real estate syndications offer investors many benefits, including cash flow, diversification, and protection against inflation. So if you’re looking for a stable long-term investment with strong returns, a real estate syndication may be right for you.

And investing in institutional quality real estate deals isn’t just for the wealthy anymore. Some of these companies and platforms allow access to non-accredited investors with as little as a $10 investment.

What platforms do you use for investing in real estate? Let us know!