Income statements are a powerful tool for evaluating the profitability of your rental property. In short, income statements (also called profit and loss statements) show how much profit or loss is generated from the operation of your rental property. This financial report breaks down your income and expenses in a given period. They can be generated on any time frame, but typically are used monthly, quarterly, or yearly.

Income statements for rental properties show the realized profits (or losses) from the operation of the rental property. This net income includes any rents or fees received and any operational expenses such as property management, taxes, or mortgage interest, but does not include any capital expenses for improvements or mortgage principal repayment. Income statements are used by investors to calculate the value of rental properties (particularly for multifamily real estate).

One big drawback of income statements is they don’t show the full financial picture for rental properties. For instance, payments to the principal of a mortgage loan don’t get reported on the income statement. This creates a discrepancy between the income reported in the income statement and the cash flow from the rental property. It is possible to have a positive number in the income statement but see your bank balance dropping.

Let’s take a more detailed look at what income statements are and how they are used for rental properties.

Who Uses Income Statements?

Publicly traded companies are required to provide income statements to their investors to provide transparency into their operations. Investors can read past income statements to get a sense of the efficiency of the company and project where they think the company’s financials are headed.

But income statements aren’t just for publicly traded companies. They are a valuable tool for individuals and companies of any size.

Think about it. What is your personal budget? If you track your monthly income and expenses to see if you’re staying within your budget, you’re effectively creating and using an income statement.

This may not be as formal as an income statement from a publicly-traded company, but the spirit is the same. You’re using it to see if you’re on track with your budget and to get a sense of what money remains at the end of the month. Isn’t that the same as determining the net income of a company?

Purpose Of Income Statements For Rental Properties

Rental properties are nothing more than a business. As a business, they generate income from rent payments and have expenses for upkeep, advertising, taxes, insurance, etc. And as a business owner, you want to have a sense of how profitable your business is, right?

That’s where income statements come in. If you’re tracking your income and expenses well, then you can easily create an income statement for your rental property to see how profitable it is.

While this can be a good indicator of the performance of your rental property, it’s not the full picture. Income statements aren’t a representation of real cash flow because they only include operating income and expenses. Cash flow, on the other hand, includes capital expenses such as improvements or mortgage principal paydown and track with the balances in your bank accounts.

So, cash flow can show you how much money you have leftover each month while income statements show you the financial performance of the rental property.

Because of this difference, cash flow is useful in determining how much money you can take out of the business while income statements can be used to provide a valuation of the business. Income statements are very useful to investors looking to purchase a rental property because they can be used to create a fair valuation of the property based entirely on the business operation. It’s the same way you would value a regular business or investment in a company’s stock.

What’s In An Income Statement?

In simple terms, an income statement is a financial report that shows income and expenses over a reporting period. Income statements compare the income and expenses from a company and provide a statement of the net income which is simply the gross income minus the gross expenses.

Income statements are also valuable documents for tax preparation. Because income statements provide summaries of the income and expenses from the business, they can be used to determine the net income that is subject to tax.

Income statements include 3 main parts; income, expenses, and net income. Both the income and expense sections provide a summary of the totals for each category and a total of all categories.

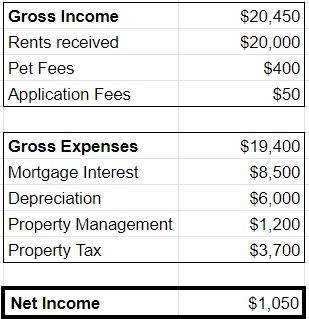

Here is a simple example of a yearly income statement from a rental property. It covers some of the basic income and expenses, however, you may have many more line items depending on your individual situation.

Income

Income from any sources is listed in this section of an income statement. This is also called gross income or gross revenue.

For rental properties, the most common income source is rent collected. But there are other ways to collect income from your rental property.

- Rents collected

- Fees assessed (late fees, pet fees, parking fees, applicaiton fees, etc)

- Utility buybacks

- Interest from bank accounts

Expenses

Rental properties have a variety of operating expenses. There are a few common expenses that almost every real estate investor incurs, and a few more that aren’t as common. Of special note are mortgage payments and depreciation.

Mortgage payments aren’t fully considered an operating expense. This is because part of the loan payment goes to pay down the principal of the loan. That gets counted in the balance sheet rather than the income statement because it is a reduction of liability.

The portion of the mortgage payment that does get included in the income statement is the interest you pay to the bank. This does not reduce the principal and so is considered an operating expense.

Depreciation is also counted as an expense on an income statement. Capital expenses aren’t counted in the income statement when they are incurred. Rather, they are depreciated over several years. The same applies to depreciation from the rental property itself.

Now that we’ve cleared up a few special considerations, here are some common expenses for rental properties.

- Property management fees

- Mortgage Interest

- Property Tax

- Depreciation

- Utilities

- Building maintenance

- Lawn care

For a full list, check out our guide to rental property expenses.

Net Income

Net income is simply the net (difference) between the income and expenses in the income statement. This can be positive or negative depending on your situation.

One special note for real estate investors is that net income typically includes an expense for income taxes. Because most rental properties act as pass-through entities for the investor, the rental property pays no income taxes. If you had structured your rental property as a C-corp for instance, it would be required to pay income taxes. This is not common.

Another caveat is that Net Income shouldn’t be confused with Net Operating Income. They sound very similar but are subtly different. Net income includes gains and losses from non-operating income and expenses like depreciation and interest. Net income is useful for tax purposes and to gauge financial performance while net operating income is used to determine the value of the rental property, particularly for multifamily real estate.

Summary

Income statements can provide you with a good sense of the financial performance of your rental property. They are also incredibly useful when it comes to tax time as you’ll get a breakdown of all the income and expenses from your rental property.

While income statements can serve as a good indicator, they don’t provide an accurate picture of your cash flow from your rental property. Income statements are just one of the financial reports you can use to evaluate and track your rental property’s finances.